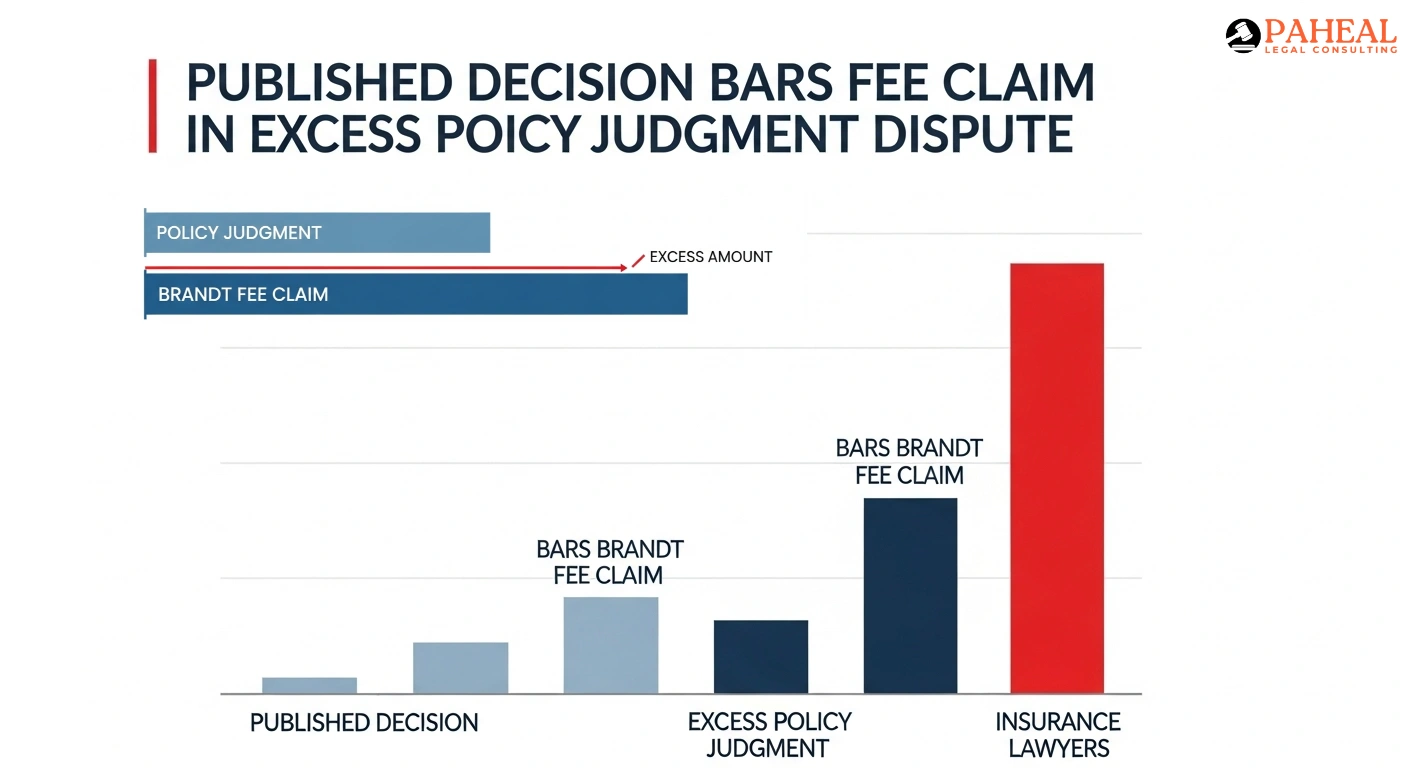

A recent federal court decision clarifies that Brandt fees are not recoverable in bad-faith insurance suits where the plaintiff seeks to recover a judgment exceeding policy limits. The court ruled that Brandt fees are limited to those insure to obtain policy benefits and do not apply to recovering damages beyond the policy limit, even in a bad-faith context. For more details.

What Are Brandt Fees

To understand that decision, you need to begin with the idea of “Brandt fees.” In so doing, the California Supreme Court in Brandt v. Superior Court (1985) found that insure are entitled to recoup their attorneys’ fees (and some pre-litigation expenses) in a suit where an insurer wrongfully or unreasonably withheld benefits own under a policy of insurance law which compelled the insured to retain counsel.

In other words: If an insurer does not pay what the policy covers, and the insured retains a lawyer only to get it to cough up what the policy says they should have receive, then those fees can be sought by the insured under the Brandt doctrine. Over time, courts have built out the components (for example, proving the insurer’s refusal was unreasonable, there were reasonable fees incurred in an effort to obtain policy benefits).

But and here’s the rub brandt fees are available only if an insure is pursuing “policy benefits” due under the contract. They are not suppose to encompass everything that might be file in a bad faith lawsuit.” The idea is base on the contractual surplus framework.

The “Excess Policy Judgment”

One of the stickiest and most mine corners of insurance and bad-faith law is what happens after the insurer has paid out policy limits but a liability judgment comes in beyond those limits. In that scenario:

The policy limit has been (or should have been) paid.

- The insurer perhaps might have settled within the limit but did not (or didn’t act unreasonably, anyhow).

- The judgment is over the policy limits and now “deeper pockets” are involve.

- The claimant (or insured) would then be allowed to sue the insurer for “bad faith failure to settle” or indemnify the excess.

Frequently in such cases, the policyholder or third-party claimant attempts to add a Brandt fee claims: “We hire lawyers to make the insurer compromise or pay what we were expose to, so by rights we should recover attorneys’ fees under Brandt.” But more often than not the insurers say, “Whoa we paid up to the policy limit in full, so we have provide the benefit promise.” So Brandt wouldn’t apply beyond that.”

Up until now, however, there was no California decision squarely holding whether the fees that could be paid as Brandt damages were recoverable by an insured who is attempting to collect its judgment in excess of policy limits where the insurer tendered a full release and paid those limits. This new decision we’re discussing reverses that.

The New Decision Key Facts & Holding

Case facts:

In Allstate Northbrook Indemnity Company v. Tran (E.D. Cal., Sept. 10, 2025) the scenario ran something like this: The policyholder’s insurer (Allstate Northbrook Indemnity Co.) reject a $250,000 “policy limits” demand made against the policyholder. This process to trial, and the plaintiff was award a judgment of nearly $3.8-million against the insured. The limit of the policy was paid ($250,000). Then the insurer file a suit for a declaratory judgment against its insured and their third-party claimant requesting an adjudication that it breach no duty and own nothing over and above the limit. This, while plaintiff/insured counter claim and sought Brandt fees.

Court’s holding:

On a motion for judgment on the pleadings, the district court held that the Brandt fee claim must be dismiss. Why? Because:

- The court reaffirm that Brandt fees are only recoverable for attorneys’ fees incurred to obtain “policy benefits.”

- A judgment in excess of policy limits is not a policy benefit for these purposes.

- Thus, where the insurer paid its contractual limit, the insure cannot recover attorneys’ fees under Brandt for the effort to recover the additional amount of the judgment above the policy limit.

If your case is about trying to force the insurer to pay beyond what the policy says it has to pay (i.e., the excess judgment amount), you can’t automatically claim Brandt fees for the legal work you did to pursue that excess.

Why the Decision Matters

This decision is a big deal for several reasons:

Clarity for insurers:

Insurers have long dreaded compulsory exposure to Brandt fees in cases of large excess judgments. This holding provides insurers with a written precedent that they can successfully invoke as a defense to Brandt fee exposure in circumstances where policy limits have been paid (in the federal district court for California). That’s a huge piece of risk reduction.

Guidance for insure and counsel:

For insureds (and their attorneys) finding themselves potentially expose to an excess judgment, the decision serves as a warning: If you are seeking recovery of Brandt fees, your focus should be on policy benefits the amount of the excess judgment. Go straight for the excess and you may cease entering Brandt country.

A shift in strategy:

What it means in practice: When settlement demands come in, policyholders and their lawyers could be stronger negotiators stuck with a policy limit as the final word on how much they can ultimately recover. Insurers might be that much more careful in handling policy limit demands, knowing that their refusal can still create bad faith exposure – but they also know they’ll (gate) have a shield against Brandt fee claims if the limit’s paid and judgment exceeds.

Publish decision sets (some) precedent:

By virtue of the decision being publish, it is something of a more stable data point for both insurers and insureds within the state of California. Historically a lot of this stuff was gray because it was an unpublish or conflicting authority. While a federal decision (E.D. Cal., it addresses California law and depends on Brandt doctrine. That puts insurers on stronger footing.

How This Decision Compares to Existing Law

Let’s map this out compare to earlier law, and highlight how this case advances or clarifies things.

The predecessor law:

Brandt held that attorney fees reasonably incur in obtaining policy benefits are recoverable where the insurer has act unreasonably.

Subsequent decisions in that line of cases held that Brandt fees constitute compensatory damages (for purposes of punitive-damage ratio analysis, etc.). See, e.g., Nickerson v. Stonebridge Life Ins. Co., supra, the California Supreme Court permitt Brandt fees to be add to the compensatory award base for punitive damages despite application of those fees after a jury determination is made.

What was less clear, however, is whether Brandt fees can be recover in excess-judgment cases (or cases where the policy limits have been paid) since previous decisions had not squarely address whether it applies to a line between policy benefits and court-impose penalties.

What this decision clarifies:

That Brandt fees do not reach legal work perform in pursuit of judgments over and above the policy-benefit obligation.

It underlines that “policy benefits” are the extent to which the insurer is contractually obligate to provide coverage not whatever that might be following a trial in the event a resulting judgment exceeds the policy limit.

Conclusion

The finding to preclude fee claims for Brandt in an excess policy judgment setting is nun pros bad‐faith jurisprudence, and that goes double for California. It puts a sharper perimeter around what qualifies as “policy benefits” for the Brandt relate purposes of attorneys’ fees, and focuses more on whether the claim attorney’s fees attach to the fundamental contractual obligation or chasing excess. Be specific about what benefit was due and build your case the same way. The news for insurers is more optimistic. Paying the policy limit can often shield you from expensive attorneys’-fees liability on a claim in the future. And to the lawyers on both sides, the message is: This ruling should lead you to re-formulate claims, demands and discovery and pleadings in above judgment worlds.